Filling out the FAFSA feels like taxes mixed with a college puzzle. The good news? The 2025–26 FAFSA is finally open, and if you know the deadlines, what tax year it uses, and a few inside tricks, the whole process gets a lot less scary.

I’ve walked through FAFSA with students and parents for years, and honestly, the mistakes people make aren’t about “not being smart” — it’s about missing the small details. Let’s break it down step by step.

Not sure where to use your FAFSA aid yet? Many online colleges and trade schools accept federal financial aid — worth comparing options before you apply.

FAFSA 2025 Quick Overview

FAFSA 2025 opens October 1, 2024, and covers the 2025–26 school year. You’ll use 2023 tax information when applying.

The FAFSA may sound intimidating, but it’s basically the government’s way of figuring out how much aid you qualify for.

Even if you think your family earns “too much,” fill it out anyway — I’ve seen plenty of middle- to high-income students on Reddit surprised with grant money or work-study they didn’t expect.

Quick Snapshot:

- Open Date: October 1, 2024

- Federal Deadline: June 30, 2026

- State/College Deadlines: Usually Jan–Apr 2025 (check local rules)

- Tax Year Used: 2023

- Cost: Free (always — avoid paid sites!)

📌 Resource: Official FAFSA site → studentaid.gov

What Is the FAFSA 2025–26?

Quick answer: The FAFSA (Free Application for Federal Student Aid) is the form students fill out to get federal grants, loans, and work-study. The 2025–26 form uses 2023 tax information and covers aid for the 2025–26 school year.

Think of it as your ticket to Pell Grants, subsidized loans, and sometimes even state or school-based aid. Without it, colleges can’t even see what you qualify for.

Even if you think you won’t qualify for aid, it’s worth filling it out. I’ve seen families with $120K income still get work-study offers or state aid because colleges wanted them enrolled.”

FAFSA 2025-2026-2027 Deadlines (Federal, State, and College)

The FAFSA 2025–26 form opened October 1, 2024, and the federal deadline is June 30, 2026. But here’s the catch: states and colleges often have priority deadlines way earlier (some as soon as March 2025).

| Type | Deadline | Notes |

|---|---|---|

| Federal | June 30, 2026 | Hard cutoff |

| State (e.g., CA Cal Grant) | March 2, 2025 | Priority deadline, money runs out |

| College priority | Varies (Feb–Apr 2025) | Check each school site |

FAFSA State Deadlines for 2025–26

| State | Deadline (2025–26 FAFSA) | Official Source |

|---|---|---|

| California | March 2, 2025 (priority for Cal Grant) | csac.ca.gov |

| Texas | Jan 15, 2025 (priority deadline) | collegeforalltexans.com |

| New York | June 30, 2025 | hesc.ny.gov |

| Florida | May 15, 2025 (priority for state aid) | floridastudentfinancialaidsg.org |

| Illinois | As soon as possible after Oct 1 (funds limited) | isac.org |

| Pennsylvania | May 1, 2025 (renewals); Aug 1, 2025 (first-time community college) | pheaa.org |

| Ohio | Oct 1, 2025 | ohiohighered.org |

| Michigan | May 1, 2025 | michigan.gov/mistudentaid |

| Indiana | April 15, 2025 | in.gov/che |

| Virginia | July 1, 2025 (priority varies by college) | schev.edu |

🔗 Source: Federal Student Aid – FAFSA Deadlines.

Deadlines sneak up fast. If you’re juggling FAFSA with AP exams or GPA goals, staying organized matters. A good start? Use an academic planner to track both FAFSA deadlines and school dates

2026-27 FAFSA State Priority Deadlines (Partial list)

| State | Priority Deadline / Notes (2026-27 year) | Link / Source (official or authoritative) |

|---|---|---|

| Florida | May 15, 2026 | Fastweb — Florida – May 15, 2026 Fastweb |

| Georgia | ASAP after October 1, 2025 | Fastweb — Georgia – ASAP after October 1, 2025 |

| Connecticut | February 15, 2026 | Fastweb — Connecticut – Submit application by February 15, 2026 |

| Alabama | Check with financial aid administrator | Fastweb (Alabama – “Check with your financial aid administrator”) |

| Alaska | ASAP after October 1, 2025 | Fastweb (Alaska) |

| Arizona | April 1, 2026 | Fastweb (Arizona – Submit by April 1, 2026) |

| Arkansas | July 1, 2026 | Fastweb (Arkansas Academic Challenge) |

| Illinois | ASAP after October 1, 2025 | Fastweb (Illinois – “ASAP after October 1, 2025”) |

| Indiana | Adult Student Grant & Frank O’Bannon: April 15, 2026 | Fastweb (Indiana) |

| Maine | May 1, 2026 | Fastweb (Maine – May 1, 2026) |

| Maryland | March 1, 2026 | Fastweb (Maryland – March 1, 2026) |

| Massachusetts | May 1, 2026 | Fastweb (Massachusetts – Submit by May 1, 2026) |

| Michigan | July 1, 2026 | Fastweb (Michigan) |

| New York | June 30, 2027 | Fastweb (NY) – note: their deadline stretches to the end of the award year |

| Pennsylvania | May 1, 2026 (for many applicants) | Fastweb (Pennsylvania) |

| Texas | January 15, 2026 | Fastweb (Texas – priority deadline) |

⚠️ Notes & Disclaimer

- This is not yet an official list — treat it as a “best known to date” reference.

- Many states still have “ASAP after Oct 1” deadlines — meaning they award on first‐come, first-served once FAFSA opens.

- Always link to the state’s official financial aid or higher education website (e.g. state scholarship commission) for final confirmation.

- Update yearly — states might shift priority dates as budgets, laws, or FAFSA rules change.

FAFSA 2025-2026 Income Limits & Eligibility

Quick answer: There’s no strict income “cut-off” for FAFSA in 2025. Even families making $150K+ may still qualify for some aid — it depends on your household size, number of students in college, and assets.

Here’s where people get confused: FAFSA doesn’t say “above this income, no aid.” Instead, it calculates something called the Student Aid Index (SAI). Colleges then use that number, along with their tuition costs, to decide your aid package.

Key factors that affect eligibility:

- Dependency status → dependent vs. independent students.

- Household size → more dependents can lower your SAI.

- Number of students in college → two kids in school at once usually means more aid.

- Parent/student income + assets → savings accounts, 529 plans, etc.

- Special circumstances → job loss, medical bills (you can appeal).

✅ Example Scenarios

- Single parent, $70K income, two kids in college: May still qualify for Pell Grant + subsidized loans.

- Married parents, $100K income, one kid in college: Likely no Pell Grant, but still eligible for unsubsidized federal loans + possible school-based aid.

I actually saw a parent on Reddit’s r/FAFSA stressing over $90K income. Other users shared that they still got state grants and low-interest loans — even when they didn’t qualify for Pell.

Tip: FAFSA is income-based, but colleges often stack aid with merit scholarships too. If your GPA needs a boost, check our GPA improvement guide — higher grades can mean more aid on top of FAFSA.

What Tax Year Does FAFSA 2025 Use?

Quick answer: The 2025–26 FAFSA uses 2023 tax info.

This is called the “prior-prior year rule.” So even if your income changed in 2024, FAFSA won’t look at that directly. You can, however, submit a special circumstances appeal to your college if your income dropped since then.

👉 Pro Tip: I’d recommend families who had a rough 2024 (job loss, medical bills, etc.) contact the financial aid office. Schools do make adjustments.

FAFSA Is First Come, First Served (Here’s Why That Matters)

Quick answer: Yes, technically the federal FAFSA deadline is 2026, but grants like state aid and some college scholarships are first come, first served. The earlier you file, the better your shot.

In my opinion, waiting until spring is a big mistake. I’ve seen students lose out on state aid just because they applied in April instead of October.

Can Parents Fill Out FAFSA 2025?

Quick answer: Yes, parents fill out the parent section if the student is dependent. The student still has to sign and submit.

Common mistake: divorced parents. FAFSA only requires the custodial parent (the one the student lives with most). Step-parents must be included if remarried.

👉 Parents filling out FAFSA? Once you know your EFC, compare schools side by side. Our School Selection Guide makes it easier to see which colleges are truly affordable.

Can You Get FAFSA With Bad Credit in 2025?

Quick answer: Yes. FAFSA doesn’t check credit for grants or federal student loans (except PLUS loans).

But… if you’re a parent with bad credit, you may be denied a Parent PLUS Loan. In that case, students can sometimes borrow extra unsubsidized loans.

👉 Example: Quora threads where parents with bad credit assumed they were out of luck but still got Pell + student loans.

Looking for FAFSA-approved online colleges? → Best Online Colleges for Working Adults

How Long Does FAFSA 2025 Take to Process?

Quick answer: Usually 3–5 days if you file online with an FSA ID. Paper forms can take weeks.

You’ll get a FAFSA Submission Summary showing your SAI, Pell eligibility, and loan offers.

If PLUS loans don’t fit your family’s credit profile, don’t panic. Many FAFSA-eligible trade schools train students for careers with lower tuition and faster payback.

FAFSA 2025 Troubleshooting (Common Errors & Fixes)

Most FAFSA errors come from typos, mismatched tax info, or wrong parent/student data. The good news? Almost all mistakes can be corrected after submission.

Common FAFSA Errors + How to Fix Them

| Error | What It Means | Quick Fix |

|---|---|---|

| Name/SSN mismatch | Info doesn’t match Social Security records | Double-check SSN + legal name spelling. Update in FAFSA if wrong. |

| Wrong parent info | Custodial parent wasn’t used | Update FAFSA with correct parent (custodial household). |

| Tax data mismatch | IRS info doesn’t line up | Use the IRS Direct Data Exchange (DDX) inside FAFSA to pull correct tax info. |

| Submitted wrong income | Forgot to include student income or mis-typed | Log in and correct it. FAFSA lets you update. |

| Missed deadline | FAFSA not processed | File ASAP — you may still qualify for loans or some aid, even late. |

Mini-FAQs from Real Students

What if I already submitted with the wrong info?

→ Log in, choose “Make Corrections,” and resubmit.

I can’t get the IRS data tool to work.

→ Enter info manually, but make sure it matches tax returns exactly.

The FAFSA site keeps crashing! (this happened in 2024 rollout)

→ Try early morning hours or call 1-800-4-FED-AID.

I found a Quora thread where a student panicked after putting the wrong SSN. Multiple answers reassured them that corrections are possible — it’s way more common than people think.

Pro Tip

I’d recommend saving a PDF of your FAFSA submission each time you update it. I’ve seen students on Reddit regret not keeping a copy when the site glitched.

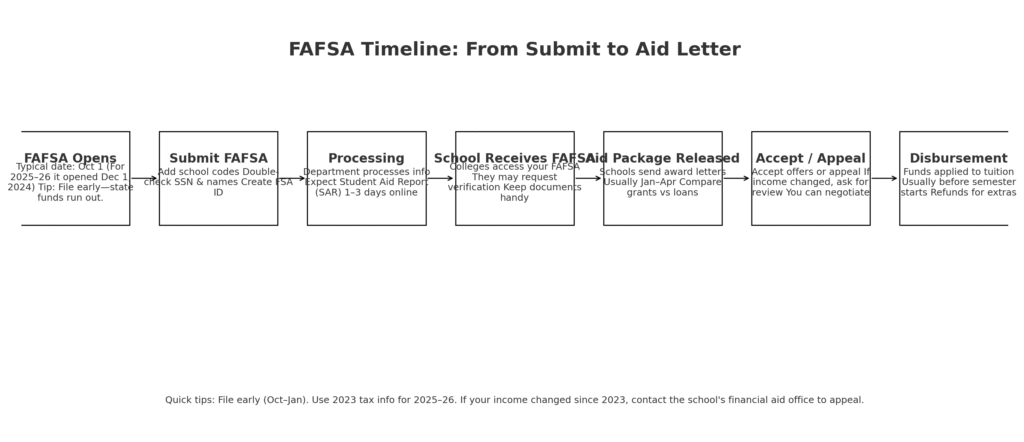

After FAFSA: What Happens Next?

Quick answer: Once you submit FAFSA 2025, your info is processed, your Student Aid Index (SAI) is calculated, and your chosen colleges receive the data. Each school will then send you a financial aid award letter — usually in early spring.

Step-by-Step: What Happens After Submission

- Confirmation Email → FAFSA will send you a submission confirmation.

- Processing by Federal Aid Office → They run your info and calculate your SAI.

- Colleges Get Your FAFSA → Every school you listed gets access to your info.

- Financial Aid Award Letters Arrive → This usually comes between March–April (for fall admissions).

- Review & Compare Packages → Grants, scholarships, loans, and work-study offers are included.

How to Read an Award Letter

Each letter is different, but here’s the breakdown:

- Free Money (grants, scholarships) → doesn’t need to be paid back.

- Work-Study → part-time on-campus jobs.

- Loans (subsidized, unsubsidized, PLUS) → must be repaid, but federal loans usually have lower rates than private loans.

👉 This is the step where families often make mistakes. They look at the “total aid number” without checking how much is loans vs. free money.

✅ Practical Example

A student on Reddit shared that their top-choice private college “gave” them $40K in aid. But when they looked closer, $30K of that was loans. Their state university offered only $20K aid, but most of it was grants. Net cost at the public school was way lower.

Pro Tip

I’d recommend building a simple comparison table in Google Sheets — line up each school’s net cost (tuition – grants/scholarships). It’s a lifesaver when you’re staring at 3–4 award letters.

Looking for flexible, FAFSA-approved colleges? Check out our list of top accredited online colleges.

FAFSA 2025 Pell Grant & Loan Limits

Quick answer: For 2025–26, the maximum Pell Grant is expected to be around $7,395, same as 2024–25 (Congress may adjust slightly). Federal loan limits depend on your year in school and dependency status.

Pell Grant Limits 2024–25 vs. 2025–26

| Year | Max Pell Grant | Notes |

|---|---|---|

| 2024–25 | $7,395 | Current official amount |

| 2025–26 | TBD (likely $7,395 or slightly higher) | Awaiting final update from Congress (usually July) |

Pell Grants go to undergrads with significant financial need. You can’t get them if you already have a bachelor’s degree.

Federal Loan Limits (Quick Breakdown)

Dependent Students:

- 1st year: $5,500 (max $3,500 subsidized)

- 2nd year: $6,500 (max $4,500 subsidized)

- 3rd+ year: $7,500 (max $5,500 subsidized)

- Lifetime max: $31,000

Independent Students (or PLUS loan eligible):

- 1st year: $9,500 (max $3,500 subsidized)

- 2nd year: $10,500 (max $4,500 subsidized)

- 3rd+ year: $12,500 (max $5,500 subsidized)

- Lifetime max: $57,500

(Source: Federal Student Aid – Loan Limits)

I’ve seen students in Quora threads asking if they should max out federal loans. My advice? Take the subsidized loans first (interest doesn’t build until after graduation), then only use unsubsidized if you truly need it. And avoid private loans unless you’ve exhausted federal options.

FAFSA 2025 Quick FAQ

Q: Is the 2025 FAFSA open?

Yes — it opened Oct 1, 2024.

Q: What tax year does it use?

2023.

Q: What’s the max Pell Grant for 2025–26?

$7,395.

Q: Is FAFSA first come, first served?

For some aid, yes. File ASAP.

Can parents fill out FAFSA for their child?

Yes. A parent can fill out FAFSA on behalf of a dependent student, but both the student and at least one parent will need separate FSA IDs to sign it electronically.

When is FAFSA due for 2025-2026?

→ Federal deadline is June 30, 2026, but most states/schools set earlier cutoffs. Check studentaid.gov for your state’s deadline.

Is FAFSA first come first serve?

→ Federal aid isn’t capped, but state and school grants often run out early. Filing in October gives you the best shot.

Can parents make too much money for FAFSA?

→ No, but higher incomes reduce Pell Grant chances. You may still get work-study or federal loans.

What tax year does FAFSA use for 2025?

→ FAFSA 2025–2026 uses 2023 tax returns (the “prior-prior” year).

Do you have to pay FAFSA back?

→ FAFSA itself is just the application. Grants = free, Loans = repay, Work-Study = earned paychecks.

How much financial aid will I get based on my FAFSA?

→ It depends on your SAI (formerly EFC), cost of attendance, and school policies. Some students get full tuition covered, others just loans.

Final Thoughts

Here’s what most parents miss: FAFSA isn’t just for “low-income families.” It’s the key to federal loans, work-study, and sometimes scholarships that aren’t advertised.

In my opinion, file early, triple-check your info, and don’t assume you make “too much” to qualify. I’ve seen families surprised in both directions — some get way more aid than expected, some less. But you won’t know unless you file.

If FAFSA doesn’t cover everything, consider alternative routes → Trade Schools Guide

FAFSA is step one — but it rarely covers 100% of costs. If you’re comparing alternatives, check out our guides to Online Colleges and Top Trade School Programs. Both paths are FAFSA-friendly and career-focused.