If you’re starting college in 2025, you’ve probably heard both FAFSA and CSS Profile tossed around like they’re the same thing — but they’re not.

Here’s the short version: FAFSA is free and used by almost all schools for federal aid, while CSS Profile is run by the College Board and used by about 300+ private colleges for institutional aid.

Let’s unpack the real differences, who needs which, deadlines to remember, and a few hidden mistakes students make every year.

Learn exactly when FAFSA opens, closes, and how your family income affects eligibility.

What Is the FAFSA? (Quick Definition + 2025 Update)

The FAFSA (Free Application for Federal Student Aid) determines your eligibility for federal grants, loans, and work-study programs. It’s free to file at studentaid.gov and opens on October 1, 2024 for the 2025–26 school year.

Expanded:

- It’s required by all accredited U.S. colleges that participate in federal aid.

- FAFSA helps you qualify for programs like the Pell Grant, Subsidized Loans, and Federal Work-Study.

- You’ll use tax data from 2023 for the 2025–26 application.

What Is the CSS Profile? (And Who Actually Needs It?)

Direct Answer:

The CSS Profile is a College Board application used by many private and a few public universities to award institutional aid — the money schools give directly.

Expanded:

Unlike FAFSA, it’s not free (costs $25 + $16 per additional school) unless you qualify for a fee waiver.

- CSS digs deeper into your family’s financial situation — including home equity, noncustodial parent income, and business assets.

- Common at selective schools like Stanford, NYU, and Boston College.

- Opens the same day as FAFSA — October 1, 2024.

In my opinion…

CSS feels more “invasive,” but it’s worth it — some students get thousands more in aid just by filing it.

CSS Profile vs FAFSA: Key Differences (Side-by-Side Comparison)

FAFSA is federal and free; CSS is institutional and paid. FAFSA focuses on income; CSS digs deeper into assets.

Comparison Table:

| Feature | FAFSA | CSS Profile |

|---|---|---|

| Managed by | U.S. Dept. of Education | College Board |

| Used for | Federal, state, and school aid | Institutional/school-specific aid |

| Cost | Free | $25 + $16 per school |

| Required by | All accredited colleges | ~300+ private/public schools |

| Parental Info | Custodial parent only | Both custodial & noncustodial |

| Home Equity | Ignored | Considered |

| Deadline | Federal: June 30, 2026 (for 2025–26) | Varies by school |

| Website | studentaid.gov | cssprofile.collegeboard.org |

This table should appear high in the post for quick scanning — high snippet potential.

If you’re targeting merit-based scholarships, understanding how your GPA impacts aid can help — here’s a quick GPA guide

FAFSA vs CSS: Which One Gets You More Money?

If you’re only applying to public universities, FAFSA usually covers all your need-based aid (like the Pell Grant or federal loans). But if you’re applying to private colleges — especially elite ones — the CSS Profile often unlocks thousands more in institutional grants that FAFSA alone can’t access.

Here’s what most parents miss:

FAFSA gives you access to federal aid. The CSS Profile, used by about 200 mostly private schools, digs deeper into your family’s finances. It can feel invasive, but that’s because those schools use their own money — and sometimes offer more generous aid packages.

Real Example (from Reddit & Forums)

On Reddit’s r/FinancialAid, one parent shared how their child got only a $5,000 Pell Grant through FAFSA, but after submitting the CSS Profile at Boston College, they unlocked $12,000 more in institutional grants.

Another student mentioned that at NYU, the CSS Profile revealed “special circumstances” (medical bills) that boosted their aid by $8,500 — something FAFSA didn’t capture.

Check if your PSAT score qualifies for major scholarships alongside FAFSA aid.

Mini Comparison Chart

| Criteria | FAFSA | CSS Profile |

|---|---|---|

| Type of Aid | Federal grants, loans, work-study | Institutional grants, scholarships |

| Max Grant (2025) | Pell Grant: up to $7,395 | Varies by college — some awards exceed $20,000+ |

| Used By | All U.S. colleges | ~200 mostly private schools |

| Depth of Info | Basic (income, dependents) | Detailed (home equity, retirement, expenses) |

| Who Benefits Most | Public college students | Private college students with moderate to high need |

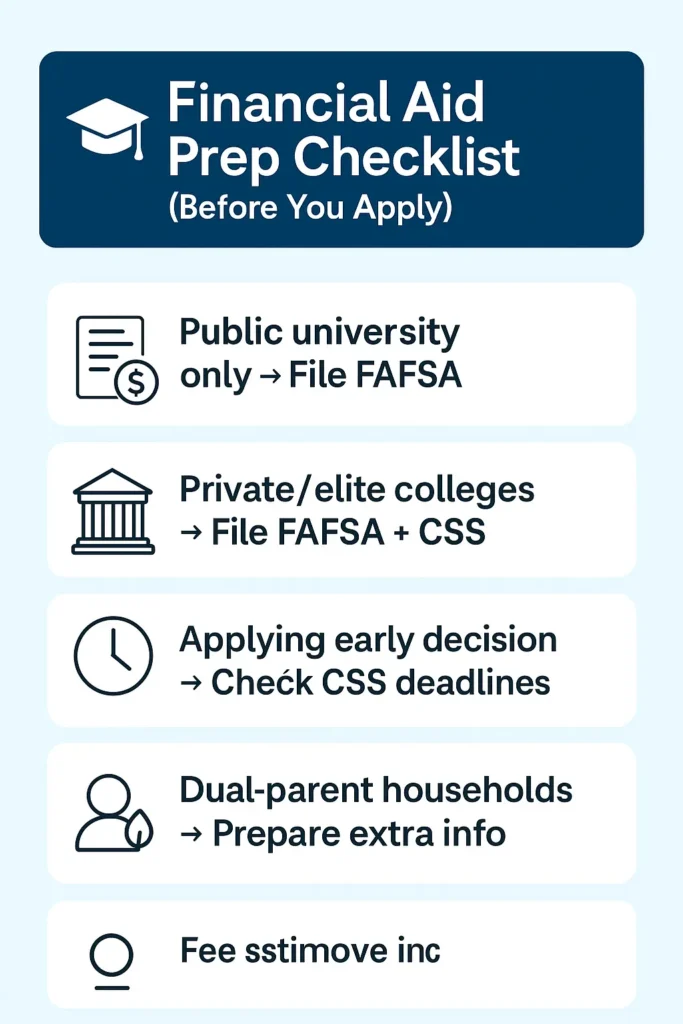

So, Which One Should You Focus On?

- If you’re applying to state or community colleges → FAFSA is enough.

- If you’re applying to private or Ivy-level schools → You must do both.

- If your family has unique financial circumstances (like medical debt or small business income) → CSS can often help you explain context FAFSA ignores.

Pro tip: Always submit both if your school accepts the CSS Profile. It never hurts to open more aid options — and colleges can’t offer what you don’t apply for.

Looking for flexible, FAFSA-eligible online colleges?

👉 Check out our guide: Best Online Colleges for Working Adults in 2025

FAFSA & CSS Profile Deadlines for 2025–26 (Chart)

Both forms open October 1, , but school-specific CSS deadlines can come as early as December .

Expanded:

Here’s a quick look at what most schools follow:

| School Type | FAFSA Priority Deadline | CSS Profile Deadline |

|---|---|---|

| Public Universities | Jan–March | Varies (some not required) |

| Private Colleges | Dec – Feb | Dec – Jan |

| Early Decision Applicants | Nov | Nov |

| Regular Decision | Feb | Jan–Feb |

Real Example:

A student from Reddit shared how missing their CSS deadline by just 3 days cost them $6,000 in aid — that’s how strict some schools are.

Keep track of AP exam dates while you plan financial aid deadlines.

Do You Need to File Both FAFSA and CSS Profile?

Direct Answer:

Most private school students should file both; public school students usually need FAFSA only.

Expanded:

If your college appears on this CSS participating list, file both forms.

- Filing both increases your aid options.

- Some schools require CSS for scholarships even if they also use FAFSA.

- Don’t assume — always check your college’s financial aid page.

What I’ve seen others do:

Many parents file FAFSA first to get their Student Aid Index (SAI), then complete CSS with those numbers handy.

👉 Thinking of switching schools or starting an online program? Check out best online colleges for working adults — many accept FAFSA aid.

Which Schools Require CSS Profile (2025 List Preview)

If you’re wondering which colleges actually require the CSS Profile in 2025, here’s a quick snapshot. Unlike FAFSA (used by all federal aid programs), the CSS Profile is used by around 250 private and elite schools to award their own institutional aid.

Top 10 Popular Schools That Require the CSS Profile

| College | Type | Notes |

|---|---|---|

| Harvard University | Private | Uses CSS for institutional aid |

| Stanford University | Private | CSS required + FAFSA |

| New York University (NYU) | Private | CSS for all undergraduate aid |

| Duke University | Private | Requires both FAFSA & CSS |

| Vanderbilt University | Private | CSS for need-based scholarships |

| Columbia University | Private | CSS required for all applicants |

| University of Chicago | Private | CSS required for need-based grants |

| MIT | Private | CSS required; institutional aid only |

| Amherst College | Private | CSS + FAFSA combo |

| Pomona College | Private | CSS required for all students |

👉 Full list: See the official College Board CSS Participating Institutions List for the complete and updated directory.

💡 Tip: Many of these top-ranked schools also offer online or hybrid programs that accept FAFSA. If you’re a working adult looking for flexible, accredited degrees, check out our guide —

Best Online Colleges for Working Adults in 2025 →

How to File FAFSA and CSS Profile

Filing both the FAFSA and CSS Profile can feel like a maze — but if you follow the right order, it’s actually pretty simple.

Here’s a quick workflow most financial aid advisors recommend.

✅ Step-by-Step Process

- Gather 2023 Tax Information

- Collect your (and your parents’) 2023 W-2s, federal tax returns, and income documents.

- You’ll use the same year’s info for both forms.

- Start with the FAFSA

- Go to studentaid.gov and submit the FAFSA first.

- Use the IRS Direct Data Exchange (DDE) tool to pull in tax info automatically — fewer errors that way.

- Wait for Your SAI (Student Aid Index)

- The FAFSA replaces the old EFC (Expected Family Contribution) with an SAI, which schools use to estimate need.

- You’ll see your SAI on your FAFSA confirmation page.

- Use FAFSA Info When Filing CSS Profile

- Go to the CSS Profile portal and reuse your FAFSA numbers for income, household size, etc.

- Some schools may ask for noncustodial parent data — check each school’s specific policy.

- Confirm Submission with Each College

- Log into each school’s financial aid portal to verify both forms were received.

- Some may need extra documentation (like IDOC uploads).

Common FAFSA & CSS Profile Mistakes (and How to Avoid Them)

Most financial aid delays come from small, fixable errors — like using the wrong parent info or skipping a signature. FAFSA and CSS Profile each have their own traps, so double-check before submitting.

Common FAFSA Mistakes to Avoid

FAFSA errors can cost students thousands in aid or delay your application by weeks. Here are the ones I see most often (and how to fix them):

- Missing the IRS Data Import (Direct Data Exchange):

Many skip linking tax info directly, which triggers manual verification later. Always use the IRS Direct Data Exchange tool. - Wrong Parent Info for Divorced Families:

The parent who provides most financial support (not necessarily who you live with) should fill out the FAFSA.

👉 Official FAFSA Parent Guide – studentaid.gov - Forgetting to Sign and Submit:

This sounds silly, but it’s the #1 delay reason on Reddit’s r/FAFSA threads. Both student and parent must e-sign using their FSA IDs. - Using an Old Email or FSA ID:

Outdated credentials lead to verification issues. Always confirm your FSA ID is active before the deadline.

Reddit Example:

“I missed my Pell Grant last year because I didn’t realize both my mom and I had to sign the FAFSA. It showed ‘Submitted,’ but it wasn’t processed.” — r/FAFSA student post

👉 FAFSA 2025-26 Application Guide

Common CSS Profile Mistakes to Avoid

CSS Profile digs deeper than FAFSA — which means more opportunities for small errors that affect aid calculations.

- Ignoring the Noncustodial Parent Section:

Many families leave this blank, but colleges require both parent profiles unless granted a waiver. - Misreporting Home Equity:

Some schools cap the value, others don’t — so check your school’s CSS instructions page before entering your home’s market value.

👉 Reference: College Board – CSS Profile Home Equity Guidance - Submitting Without Supporting Documents:

Colleges may ask for W-2s or tax forms through IDOC. Skipping this step can freeze your aid review. - Forgetting to Update After Changes:

If income or household info changes mid-year, update your CSS profile. Colleges often recalculate aid.

💬 Parent Quote (Quora):

“Our home equity was counted at full market value on the CSS Profile, and we lost $8K in need-based aid. I wish I’d checked the school’s cap policy first.” — Quora discussion on CSS Profile parent mistakes

👉Best Private Colleges for Financial Aid in 2025

How to Decide Which One Applies to You

If you’re applying to public universities, FAFSA is enough. If your list includes private or selective schools, you’ll need CSS too.

It’s better to spend a few hours now than lose thousands in aid later.

FAQ: FAFSA vs CSS Profile

Q1. Does every college require CSS Profile?

No — only around 300 schools do. Most public universities use FAFSA only.

Q2. Can I edit my CSS Profile after submission?

No direct edits — you must contact each college’s aid office. FAFSA, however, can be corrected online.

Q3. Are international students eligible?

Yes, many schools use CSS for international applicants (unlike FAFSA).

Q4. Is CSS worth paying for?

If you’re applying to private colleges — absolutely. It unlocks school-specific grants and scholarships

Final Thoughts: FAFSA vs CSS — Which Should You File in 2025?

If you’re unsure, file both. FAFSA is free and gives you federal aid; CSS might unlock thousands more from your college.

In my opinion, skipping CSS just because it’s paid is like leaving money on the table.

Looking for accredited programs that accept FAFSA or offer school-based aid?

👉 Explore online colleges for working adults.

Nawab, an educator teaching K-12 since 2010, holds an English honors graduate degree and a diploma in elementary education. He has also been blogging for five years, sharing insights for educators and parents.