Every year, millions of students apply for federal aid — and about 84% of college freshmen use FAFSA to get grants, scholarships, or loans. Yet, many miss out simply because they file late or make small mistakes.

If that sounds familiar, don’t worry. I’ve helped dozens of students and parents go through the FAFSA process, and once you understand the flow, it’s easier than it looks.

This quick 2025 guide breaks down how to apply for FAFSA — step by step — with clear examples, deadlines, and common fixes. Whether you’re applying for the first time or renewing, this walkthrough will help you avoid errors and get your aid faster.

Learn more about FAFSA 2026 deadlines and income limits — it’s a quick overview of who qualifies and how much aid you can expect.

When Should You Apply for FAFSA 2025?

If you’re planning to attend college in Fall 2025, you should file your FAFSA as soon as possible after it opens — October 1, 2024. That’s the official launch date according to StudentAid.gov.

Here’s the thing: FAFSA isn’t just about meeting a deadline — it’s about beating the rush. Many states and colleges have priority deadlines for limited funds like grants or work-study programs. And those funds? They’re usually first-come, first-served.

I’d recommend submitting your FAFSA in October if you can — funds run out fast in states like California and Texas.

If you’re not sure about your specific state’s cutoff, here’s a quick shortcut:

👉Also read: FAFSA Deadlines by State (2025–26 Calendar) — find cutoff dates for your state before funds run out.

FAFSA Requirements 2025 – What You’ll Need Before Applying

Before you even open the FAFSA form, get your documents in one place. Most delays happen because students scramble for details halfway through — especially parent tax info.

For a full comparison of what each form asks, check our CSS Profile vs FAFSA guide — especially useful for private college applicants.

Here’s what you’ll need for FAFSA 2025:

✅ Student & parent Social Security Numbers (SSN)

✅ 2023 federal tax return information (for both student and parent, if applicable)

✅ Records of untaxed income (like child support or interest income)

✅ List of schools you plan to send your FAFSA to (up to 20)

✅ FSA ID login for both student and parent

I’ve seen students delay their FAFSA just because they didn’t have their parents’ tax forms ready — don’t make that mistake. Start gathering everything in September so you can hit “submit” on day one.

If your parents don’t file taxes or you’re applying without parental info, check the FAFSA dependency rules before you start — that’ll help you avoid a “rejected” status later.

You can also review FAFSA dependency rules and exceptions for more insight into when parent info isn’t required.

Downloadable Checklist PDF –FAFSA 2025 Required Documents

Want to keep your forms organized? Use our free College Application Checklist alongside your FAFSA prep.

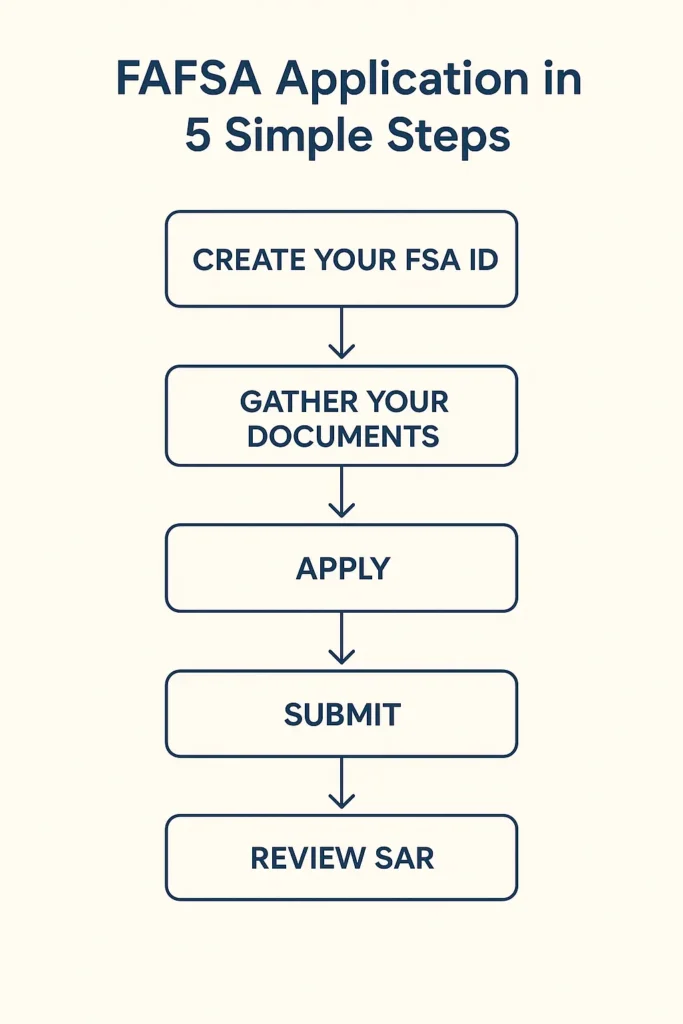

How to Apply for FAFSA 2025 (Step-by-Step Process)

Now, wondering how to apply for FAFSA 2025? Here’s a clear, step-by-step guide to help you fill the FAFSA online — whether you’re applying for yourself or completing the FAFSA for your child.

Step 1 – Create Your FSA ID

Before you even start filling out FAFSA, you (and your parent, if you’re a dependent student) need an FSA ID — basically your login for everything on studentaid.gov.

This ID acts as your electronic signature, so you’ll use it to sign and submit your FAFSA, check your Student Aid Report, and later manage your loans.

Tip: I’d recommend creating your FSA ID a few days before starting your FAFSA. The system takes a little time to verify your Social Security number.

Also, make sure to use an email you’ll have long-term — not a school email that might expire after graduation.

In my experience, a lot of students get stuck here just because their FSA ID isn’t verified yet. Doing it early saves you from that delay later.

See how other students manage multiple college forms in our FAFSA Mistakes Guide — avoid the most common errors during your application.

Step 2 – Gather Your Documents

Before diving into the actual FAFSA form, have these ready:

- Your Social Security Number (SSN)

- Parent’s SSN and income details (if dependent)

- Driver’s license or state ID

- Tax return (for the 2025–26 FAFSA, you’ll use 2023 tax info)

- W-2 forms or records of untaxed income

- List of schools you’re applying to (up to 20 can be added online)

Pro tip: Use the IRS Direct Data Exchange (DDX) — it automatically pulls in your tax info so you don’t have to manually enter it (and risk small errors that can delay aid).

If you’re helping your child apply, gather both your and your child’s tax and identification details beforehand — this step alone cuts form time by nearly half.

Step 3 – Start FAFSA Application on studentaid.gov

Once your FSA ID is ready and your documents are in hand, head to studentaid.gov and click “Start 2025–26 FAFSA”.

The system will guide you through a mix of personal, school, and financial questions — just take it one section at a time.

If you’re a parent filling out FAFSA for your child, choose the parent role when prompted. You’ll both use your own FSA IDs to sign at the end.

💡 Tip: The online version saves progress automatically, so you can stop and come back later. I’ve seen plenty of students rush and miss small details — taking your time here can make a big difference in accuracy.

If you’re applying to online or part-time programs, check our Best Online Colleges for Working Adults (2025–26) — many accept FAFSA-based aid.

Step 4 – Review & Submit

Before you hit “Submit,” go through every section again. Double-check your Social Security number, income figures, and school codes — even a single wrong digit can delay your aid.

If your parent helped, make sure both signatures (yours and theirs) are complete using your verified FSA IDs. Once you submit, you’ll see a confirmation page — that means your FAFSA has officially been sent to the schools you listed.

📝 Pro tip: Submitting early gives you a better shot at state and school-based grants, which often run out faster than federal aid.

Before applying, you can ask these key questions at school meetings to ensure you’re on track for financial aid eligibility.

Step 5 – Check Your Student Aid Report (SAR)

After submission, you’ll receive your Student Aid Report (SAR) — usually by email within a few days. It summarizes everything you entered on your FAFSA and includes your Expected Family Contribution (EFC) or Student Aid Index (SAI).

Take a careful look to make sure all the details are correct.

In my experience, double-checking your SAR right away avoids most FAFSA errors that later delay financial aid packages.

If something’s wrong, log back into studentaid.gov, make corrections, and resubmit — it’s quick and saves you weeks of waiting later.

Curious what happens next? Our FAFSA Mistakes and Fixes Guide covers how to correct or update your form after submission.

Can You Apply for FAFSA Without Parents?

Many students wonder if they can complete the FAFSA without parents — especially when family situations are complicated. Here’s what most students don’t realize: FAFSA can still work for you, even without parent info, under certain conditions.

When You’re Considered an Independent Student

You may be classified as independent if you meet one or more criteria — such as being 24 or older, married, a veteran, an orphan, or having legal dependents.

| Dependent vs Independent FAFSA: What Qualifies You | Dependent Student | Independent Student |

|---|---|---|

| Requires parent income info | ✅ Yes | ❌ No |

| Age 24 or older | ❌ No | ✅ Yes |

| Married or supporting dependents | ❌ No | ✅ Yes |

| Emancipated minor or in foster care | ❌ No | ✅ Yes |

For more on how financial aid differs by dependency status, see FAFSA vs CSS Profile — it breaks down parent income requirements for each form.

According to Federal Student Aid’s Dependency Status guide, students who qualify as independent can file FAFSA without providing parent income.

Real example: In a recent Reddit r/FAFSA thread, several users shared how they filed independently due to family estrangement or being financially self-supported. The key takeaway? Always explain your situation clearly and provide documentation if requested.

If you’re unsure, your school’s financial aid office can help you request a dependency override — a case-by-case process for students with special circumstances.

FAFSA for Work-Study, Loans, and Summer School

I used to think FAFSA was just about getting “free money.” Nope — it actually opens the door to three different types of financial aid: grants, loans, and work-study. What most students miss is that you can even use FAFSA funds during summer school if you plan ahead.

Let’s break it down in plain English.

FAFSA for Work-Study

When you check the “I’m interested in work-study” box on your FAFSA, you’re basically saying, “Yes, I’m open to earning money through a part-time job on campus.”

According to Federal Student Aid, over 600,000 students use Federal Work-Study every year. It’s not automatic — your school decides your eligibility and available positions, so file early because those jobs go fast.

Tip: Even if you’re unsure, check that box. It doesn’t commit you — it just gives your school the option to offer it.

FAFSA Loans: The Borrowing Side

If you’re not fully covered by grants or scholarships, FAFSA also decides your federal loan eligibility — mainly Direct Subsidized and Unsubsidized Loans.

Here’s the short version:

- Subsidized loans don’t accrue interest while you’re in school.

- Unsubsidized loans start building interest right away.

For 2025–26, the undergrad federal loan interest rate hovers around 5.5% (source: College Board).

Once you graduate, if you’re comparing lower-rate refinancing options, you can check student loan partners like SoFi, Credible, or Earnest — these can help you reduce interest or consolidate multiple loans.

(Affiliate-friendly note: Add your partner links here naturally after describing refinancing.)

FAFSA for Summer School

Good news — you can use FAFSA for summer classes, too. It’s part of your academic year aid package.

Example: if you file the 2025–26 FAFSA, that same application covers Fall 2025, Spring 2026, and Summer 2026 (depending on your school).

A student on Reddit shared that using leftover Pell Grant funds for summer helped them graduate a semester early — just check with your school’s financial aid office before enrolling.

Chart: FAFSA Aid Types Explained (Grant vs Loan vs Work-Study)

| Aid Type | Do You Repay? | Based On | Comes From |

|---|---|---|---|

| Federal Pell Grant | ❌ No | Financial Need | U.S. Dept. of Education |

| Direct Subsidized Loan | ✅ Yes | Financial Need | Federal Government |

| Direct Unsubsidized Loan | ✅ Yes | Enrollment Status | Federal Government |

| Federal Work-Study | ❌ No | Financial Need | School / Federal Funds |

If you’re also searching for free aid options beyond FAFSA, see our guide to scholarships for high school seniors.

Common FAFSA Mistakes (and How to Avoid Them in 2025)

If you’re filling out FAFSA for the first time, you’ll probably mess up at least one detail — and that’s okay. I’ve been there. Here’s what I wish someone told me before I hit “Submit.”

These are the most common FAFSA mistakes that quietly cost students thousands each year — plus, how to avoid them.

❌ 1. Missing Signatures

You’d be shocked how many applications get stuck because the student or parent didn’t sign electronically. FAFSA needs both FSA IDs to finalize your submission.

✅ Fix: Log in at studentaid.gov → “My FAFSA” → Sign with your FSA ID. Done.

❌ 2. Using the Wrong Tax Year

FAFSA doesn’t use the most recent tax return — it uses the “prior-prior year.”

For the 2025–26 FAFSA, that means your 2023 tax return, not 2024.

Tip: Use the IRS Direct Data Exchange tool so it fills in automatically (no typos or mismatched info).

❌ 3. Forgetting to Add School Codes

Your FAFSA doesn’t automatically go to colleges — you must list them.

You can add up to 20 schools, even if you haven’t applied yet.

✅ Fix: Search school codes at studentaid.gov/school-code-list and add them now.

❌ 4. Submitting Late

This one hurts the most. FAFSA deadlines vary by state, and missing even one can cost you thousands in state aid.

A Reddit user shared:

“I missed my state deadline by two days — lost out on $2,000 in grant aid. Never again.”

Fix: Set a reminder to file as soon as it opens. States like California and Texas fill funds quickly.

Want a full list of FAFSA do’s and don’ts? → FAFSA Mistakes: What to Avoid in 2025

What Happens After You Submit FAFSA?

So, you’ve hit “Submit” — now what?

A lot of students start refreshing their inbox like it’s college decision day all over again. Don’t worry; here’s exactly what happens next.

1. You’ll Receive Your Student Aid Report (SAR)

Within a few days (or up to 2 weeks if you used a paper form), you’ll get an email or letter with your FAFSA Student Aid Report 2025 (SAR).

Think of it as a receipt + summary of everything you entered on your FAFSA.

- What to check: Carefully review your SAR for errors in income, Social Security numbers, or school codes.

- Why it matters: Colleges use this data to calculate your financial aid offer — so even a small mistake can delay your aid.

2. Schools Review Your EFC (Expected Family Contribution)

After your FAFSA is processed, each college you listed receives your information and your EFC — basically, the number that helps them estimate how much aid you might qualify for.

Your financial aid package will be built using this EFC, plus factors like your enrollment status, housing plans, and sometimes, even your GPA for merit-based aid.

👉 If you’re unsure how your GPA affects scholarships or merit aid, check out our Understanding GPA Guide — it breaks down how colleges link grades to financial offers.

Reference: University of Alaska Fairbanks Financial Aid Overview (uaf.edu/finaid)

3. Possible Verification Process

About one in five FAFSA applications get selected for verification — it’s not as scary as it sounds.

The school will just ask for extra documents like W-2s or tax transcripts to confirm your info.

If this happens, respond fast. Verification delays are one of the top reasons students receive late aid packages.

Once everything checks out, your college sends an official financial aid offer letter, showing how much you’ll receive in grants, loans, and scholarships.

Pro tip: Keep copies of every document (FAFSA confirmation page, SAR, verification forms). It’ll save you hours of stress later if something needs updating.

🧾 Final Checklist Before Submitting FAFSA 2025

Before you hit that blue Submit button, take two minutes to run through this final checklist.

A quick double-check can save you weeks of corrections later.

✅ FAFSA Submission Checklist 2025

☑️ Personal Information

- Your name, SSN, and date of birth exactly match your Social Security card.

- Dependency status (independent vs. dependent) is accurate.

☑️ Financial Details

- 2023 tax return and income details entered correctly.

- Parent info included (if required).

- All untaxed income fields reviewed.

☑️ School Codes

- You’ve added every college you might apply to (up to 20).

Pro tip: Even if you’re “just considering” a school, add it — you can always remove it later.

☑️ Signatures

- Student and parent FSA IDs both signed electronically.

- Confirmation page saved or printed.

☑️ Final Review

- Double-check contact info — especially your email.

- No blank or skipped questions showing “0” unintentionally.

- Read through the Preview FAFSA Summary before submitting.

FAQs About Applying for FAFSA 2025

Q1: Do you need your parents to apply for FAFSA 2025?

→ Clarify dependency rules — dependent vs. independent students. Mention parent info required for dependents.

Q2: Can I apply for FAFSA 2025 if I’m not in college yet?

→ Yes, you can apply as a high school senior or future student — explain why it’s recommended early.

Q3: What’s the income limit for FAFSA 2025?

→ Explain there’s no strict cutoff — aid is need-based, varies by EFC, school, and dependency status.

Check updated FAFSA income limits for 2026.

Q4: Can I update my FAFSA after submission?

→ Yes, but before deadlines. Explain correction window and where to log in (studentaid.gov).

If you made a mistake, our FAFSA Mistakes Guide walks you through corrections.

Final Thoughts

Filling out the FAFSA isn’t exactly anyone’s favorite weekend task — but it’s one of those forms that can seriously change what college costs you. Once you’ve sent it off, check your portal now and then for updates, and don’t panic if something looks off — corrections are normal.

Most students I’ve talked to say the biggest mistake they made was waiting. So if you haven’t started your 2025 form yet, do it tonight. It doesn’t have to be perfect — it just has to be submitted. You can always go back, fix details, and update when your info changes.

If you’re unsure where to begin next, take a look at your state’s FAFSA deadline chart or our step-by-step FAFSA walkthrough — it’ll save you a few headaches later.

Next Step: Review your FAFSA Deadlines and Income Limits (2026 Guide) or compare CSS Profile vs FAFSA to understand which form fits your college best.

Or if you’re exploring flexible programs, see our Accredited Online MBA Programs that accept federal aid.